Today’s supply chains move millions of shipments around the world each year, but just think for a moment about the information required to ensure these shipments get from A to B safely and on time. The information flows, primarily based on EDI/B2B transactions, to support today’s global supply chains are growing in volume year-on-year.

What benefits could a business obtain by being able to monitor these information flows and obtain deeper insights into what makes supply chains ‘tick’? Say hello to supply chain analytics. Monitoring the day-by-day, hour-by-hour, or minute-by-minute ‘pulse’ of a supply chain could potentially bring significant operational and business benefits to a company. From a supply chain point of view, companies are looking for answers to questions such as:

- Who are my top suppliers and how many B2B transactions have I exchanged with them?

- Who are my top (and bottom) performing suppliers based on specific key performance indicators such as complete orders, accurate shipments, on-time deliveries and processing of payments?

- For which suppliers/customers has the order/payment volume increased or decreased by more than 30% over the last 12 months?

- Which of my customers sent me the most orders during the end of year holiday period and which ones sent many changes?

Here at OpenText we are processing over 16 billion transactions per year across our Trading Grid B2B network. These transactions are feeding global supply chains with rich information to help ensure that orders are processed in time, deliveries are shipped to the correct destinations and invoices not only get paid on time but comply with the ever increasing number of compliance regulations.

Now what if you could apply Big Data analytics to supply chain operations in order to obtain deeper insights into how your digital information flows are supporting your physical shipment flows around the world?

According to many leading analysts, Business Intelligence and Analytics are the most important focus areas for the CIO in 2016. Big Data analytics has been around for a few years now, really emerging in 2010 with mobile and cloud based technologies, but it is really only over the last two years that companies have started to embrace Big Data across the enterprise. You only have to look at recruitment websites to see that one of the hottest jobs in the market at the moment are for Big Data Scientists, those that can understand rich data sets, analyse and then report on them.

There are many EDI document standards supporting today’s global supply chains, with ANSI and EDIFACT formats being the most prevalent. But if you go to the EDI document level there are really just two types of information that are useful from a supply chain analytics point of view. Firstly,operational-based information and secondly, business specific information, so what does this information actually look like?

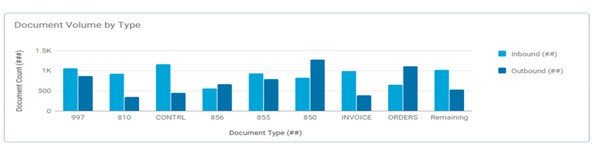

Operational information could be considered as the type of documents flowing between trading partners across a supply chain, so this would include Purchase Orders, Invoices, Advanced Ship Notices (ASNs) and Order Acknowledgements. The volume of these transactions could run into thousands, or for a large global company, millions per year. What if you could use this information to determine the volume of transactions by document type and volume of transactions by trading partner?

Applying analytics, let’s call it operational in nature, could help to determine the top trading partners that a company deals with on an annual basis and also provide insights into the most popular document types being exchanged. Chances are, companies doing business only in North America will be exchanging more ANSI-based documents while companies doing business on a global basis will be using EDIFACT. So, Operational Analytics could be defined as delivering transactional data intelligence and volume trends needed to improve operational efficiencies and drive company profitability.

Business information could be considered as the data from within each document type. So for example for an ASN, it would contain information such as delivery address, shipment details, quantity, sender details etc. What if you could actually perform deep introspection on each business transaction as it flows across a B2B network and then use this information to produce a series of business-related trends that could be reviewed, and if necessary, acted upon?

Applying analytics, in this case business analytics, could potentially help a business to determine ASN timeliness, Invoice Accuracy, Price Variance and so on. If there are any exceptions or errors then the business can take corrective action and resolve any problems much sooner. So, Business Analytics could be defined as delivering business process visibility required to make better decisions faster, spot and pursue market opportunities, mitigate risk and gain business agility.

Applying operational and business analytics to a pool of billions of transactions flowing across a business network could transform the day to day work activities of supply chain, logistics and procurement professionals around the world.

Let me briefly highlight two use cases for supply chain analytics.

The retail industry is highly consumer driven and seasonal in nature which introduces significant fluctuations in the procurement process. Being able to monitor the volume of documents, by type, across a business network can potentially provide retailers with some interesting indirect insights into consumer demand in different markets around the world.

Applying operational analytics, especially when applied to a few years of historical data could help to forecast potential order volumes and therefore allow retailers to be better prepared for seasonal fluctuations. Operational analytics, based on B2B transactions could potentially transform the retail industry, making it more responsive to consumer demands and ensure that inventory levels are aligned more accurately with expected demand levels.

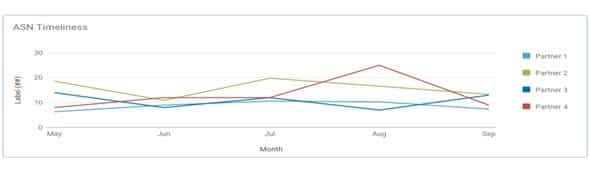

In the automotive industry, ‘ASN Timeliness’ is one of the most important variables measured to ensure that Just-in-Time production lines are running smoothly. ASN timeliness can be defined as the number of ASNs sent on time divided by the total number of shipments within a specified time period. Many automotive companies use ASN timeliness as the basis of monitoring the performance of their trading partner community. Applying business analytics in this case allows a car manufacturer to not only monitor supplier performance from an ASN delivery point of view, but also compare suppliers against each other to create a top ten ranking of delivery.

What if you could monitor the ‘live’ transactions flowing across a business network and apply business analytics to monitor trends and exceptions before they impact the business? As shown by the ASN timeliness chart above you can use analytics to very quickly assess and compare the performance of your trading partners. Some car manufacturers use ASN timeliness as the basis of determining whether penalties or even contract termination should be applied.

So in summary, applying analytics across trading partner information flowing across a business network could:

- Provide a complete 360 degree view of supply chain activities

- Offer deeper insights into transaction based trading partner activities

- Provide earlier identification of exceptions, allowing corrective action to be taken sooner and prevent supply chain disruptions

- Allow more informed business decisions to be made

The two examples above are based on company specific transactions flowing across a business network, but what about looking at a community as a whole? Applying analytics to an entire community of companies connected to a business network could provide some interesting insights into business/industry activity as a whole.

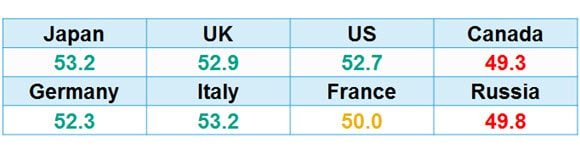

Every month the manufacturing industry, one of the main contributors towards a country’s GDP, waits to hear from global economists as to how each country around the world has performed. The Purchasers Managers Index (PMI) measures eight key metrics each month, for example number of new orders, stock levels, production output and changes in employment levels.

A PMI number above 50 signifies that a country is in growth and a number below 50 signifies contraction. Three periods of contraction will normally signify that a country is going into recession. The numbers below relate to the January 2016 manufacturing PMI numbers for the G8 member countries. You can quickly see here that Japan and Italy tied in January as the fastest growing economies in relation to manufacturing PMI.

OpenText™ Trading Grid connects over 600,000 companies, and processes over 16 billion transactions with a commerce value of over $6.5 trillion. Applying analytics to this scale of transaction volumes could provide deep and very rich insights at both industry and country level as to what is happening from a business growth or contraction perspective. If you were to apply analytics to a community of trading partners on this scale then in theory our results should be broadly in line with the PMI trends, especially as many of the order volumes for example being measured as part of the PMI process are actually moving across our Trading Grid infrastructure as EDI transactions.

I have only scratched the surface in this blog about how analytics can be used to provide operational, business, customer and community-related insights to supply chain operations and further blogs over the next few months will take a closer look at each of these areas. If you would like to see how analytics can be used in a different situation, in this case to monitor the US elections coverage, take a look at our Election Tracker. Also take a look at Trading Grid Analytics, a new breed of embedded analytics that provide insights across entire business flows.